oniongate.ru News

News

How To Trade Mark My Logo

Registering Your Trademarked Logo · Logo Design To achieve registration, your logo must be distinctive in design. · Trademark Search You cannot trademark a logo. You'll always have at least a small fee to pay. Beyond that, there are several different routes you can take when filing your trademark application. Watch this. Federal Registration Requirements. Federal registration may be obtained by contacting the United States Patent and Trademark Office at Trademarks can apply to business names, slogans, symbols, logos, sounds, colors, and even scents symbolic of a specific brand. They give you exclusive rights to. One thing I've seen during my many years of working with small businesses and organizations is that their logos tend to change over time, whereas the names they. This guide will lead you through key steps for trademarking a company name and logo with confidence. You will need to register it as a trademark with the United States Patent and Trademark Office. The name that you select for your company must be distinctive to. Hello,The topic of logos are covered by trademark, and potentially copyright laws. If you are interested in using the logo on a national scale then the only way. Whether you should trademark your logo, brand name, and slogan simultaneously depends on the level of protection you are looking for and how you use the. Registering Your Trademarked Logo · Logo Design To achieve registration, your logo must be distinctive in design. · Trademark Search You cannot trademark a logo. You'll always have at least a small fee to pay. Beyond that, there are several different routes you can take when filing your trademark application. Watch this. Federal Registration Requirements. Federal registration may be obtained by contacting the United States Patent and Trademark Office at Trademarks can apply to business names, slogans, symbols, logos, sounds, colors, and even scents symbolic of a specific brand. They give you exclusive rights to. One thing I've seen during my many years of working with small businesses and organizations is that their logos tend to change over time, whereas the names they. This guide will lead you through key steps for trademarking a company name and logo with confidence. You will need to register it as a trademark with the United States Patent and Trademark Office. The name that you select for your company must be distinctive to. Hello,The topic of logos are covered by trademark, and potentially copyright laws. If you are interested in using the logo on a national scale then the only way. Whether you should trademark your logo, brand name, and slogan simultaneously depends on the level of protection you are looking for and how you use the.

When you register your mark with the USPTO, there will be a public notice stating your ownership, and it will be listed in the online database. With a federally. To register and trademark your brand name, search the TESS database for similar brand names, fill out the trademark application and submit it to the USPTO for. Go to USPTO, fill the application of trademark registration, and pay for each registration & class. Part oniongate.ru I Need to Trademark My Business Name? Oftentimes. Generally, you trademark an image by applying to the US Patent and Trademark Office (USPTO) and getting your application approved for registration. If you're just filing a trademark, do it yourself on the USPTO website and save yourself money (assuming you're from the US). Distinguish your goods or services in the market place by using a trade mark. Your trade mark could include words, logos, shapes, colours, sounds, smells or. US trademark law enables you to protect a logo design, word mark or any other brand identifier from being used by another third party. Create your mark! Decide what words and/or design elements your trademark or service will contain – then perform the following steps to get your mark registered. How To Copyright a Logo in 3 Steps: · Use the © copyright symbol on your work · Ensure you can prove the date of creation · Register with a copyright witness. A trademark protects the specific, unique name, logo, and symbols pertaining to your products or business brand. Trademark protection may apply to business. This article describes the differences between these various types of trademarks and the considerations for entrepreneurs interested in trademark protection. mark. If, for example, you use the logo, brand name, and slogan together, you can include them in one application that will be filed as a figurative. It varies depending upon the content of the logo. As a general rule it makes very good sense to register your trade mark, no matter what it is. Logo used by a company typically contains both the visual identity of the brand and the name of the brand. Since trademark registration protects against. Can you trademark a logo? You can trademark your brand logo and, if it's sufficiently unique, your brand name. If you have individual products with their own. Does my logo qualify for trademark protection? If your trademark is robust and distinctive, it will likely be accepted. However, if it lacks sufficient. In order to obtain a trademark, you must be the original creator or owner of the logo. Trademarks are used to protect original works of. This is important: this means that the federal protection you acquire from the USPTO only applies to the mark as it's been registered. So, if you file your name. How to trademark a logo A unique logo can be trademarked by registering it with the USPTO. Anyone can apply online if their business is based. No, you have to use the logo in commerce to show the source of a good or service in order to be registered as a trademark.

Pre Market Movers Investing

TOP GAINERS ; ALGN · Align Technology Inc. , % ; UBER · Uber Technologies Inc. , % ; CZR · Caesars Entertainment Inc. , %. Biggest movers among U.S.-listed issues outside of regular trading hours with a minimum share price of $2 and minimum pre-market or after-hours volume of. Monitor leaders, laggards and most active stocks during premarket trading. Premarket Losers ; 15, WHLR, Wheeler Real Estate Investment Trust, Inc. %, ; 16, ATNF, Life Sciences Corp. %, Markets. Deals · Fixed Income · Factor Investing · Alternative Investing · Suning's Singapore Ready to Make 'Bold Changes' to Revive Stock Market · Canadian. After-hours US stock movers ; VALE. + ; CVE. + ; NVDA. - ; CNQ. + ; PCG. + Explore the biggest gainers across United States stocks. oniongate.ru provides all the needed data, real time prices, historical chart, news and analysis. US Stocks Pre-Market trading hours are am ET through am ET. Data displayed is delayed a minimum of minutes and only updated during the pre-market. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. TOP GAINERS ; ALGN · Align Technology Inc. , % ; UBER · Uber Technologies Inc. , % ; CZR · Caesars Entertainment Inc. , %. Biggest movers among U.S.-listed issues outside of regular trading hours with a minimum share price of $2 and minimum pre-market or after-hours volume of. Monitor leaders, laggards and most active stocks during premarket trading. Premarket Losers ; 15, WHLR, Wheeler Real Estate Investment Trust, Inc. %, ; 16, ATNF, Life Sciences Corp. %, Markets. Deals · Fixed Income · Factor Investing · Alternative Investing · Suning's Singapore Ready to Make 'Bold Changes' to Revive Stock Market · Canadian. After-hours US stock movers ; VALE. + ; CVE. + ; NVDA. - ; CNQ. + ; PCG. + Explore the biggest gainers across United States stocks. oniongate.ru provides all the needed data, real time prices, historical chart, news and analysis. US Stocks Pre-Market trading hours are am ET through am ET. Data displayed is delayed a minimum of minutes and only updated during the pre-market. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures.

The experts at Fidelity offer investing insights & analysis to help you invest smarter Trending Stocks. Market Movers; Top Rated by Sector; Orders by Fidelity. This function allows you to quickly obtain any market mover before/ after trading hours. The most typical cause for large stock movement before or after trading. Market Movers Investing percentage, trading volume, intraday highs and lows, and day charts. by Fidelity Customers. Stock. Today's pre-market stock movers: TLRY, ACB, CGC and more ; $Tilray Brands (oniongate.ru)$ +% ; $Aurora Cannabis (oniongate.ru)$ +% ; $Canopy Growth (oniongate.ru)$ +10% ; $. Premarket trading coverage for US stocks including news, movers, losers and gainers, upcoming earnings, analyst ratings, economic calendars and futures. Top Gainers ; TILInstil Bio, Inc% ; AZULAzul S.A% ; RDFNRedfin Corporation% ; RHRH% ; SNBRSleep Number Corporation%. Top After-Hours Stock Gainers ; SWTX. Springworks Therapeutics. $, $ ; CRBG. Corebridge Financial, Inc. $, $ ; ASND. Ascendis Pharma. $ Premarket Gainers ; 1, TNON, Tenon Medical, Inc. ; 2, NOVV, Nova Vision Acquisition Corporation ; 3, ATPC, Agape ATP Corporation ; 4, OMIC, Singular Genomics. stock market analysis, updates, research, and investing ideas. It's our Find overseas stock market updates, pre and post-market movers, company and. However, when the regular market opens for the next day's trading (when most individual investors will have the opportunity to buy or sell), the stock may not. The Pre-Market Indicator is calculated based on last sale of Nasdaq securities during pre-market trading, to am ET. Our streamlined list of today's top pre-market gainers. Capture early momentum and investor interest with these potential front-runners in the market. Many investors and traders watch the pre-market trading activity to judge the strength and direction of the market in anticipation of the regular trading. If you see a stock that is changing in price (is a pre market mover) before the opening of the market, you will be in a position that you can research as to why. On a typical day, more shares trade hands in the first hour than during any other, as orders placed when the market was closed are processed. Volume tends to. US stocks below gained the most in price during the post-market session. They are sorted by post-market price percentage change and supplied with other. Welcome to the final trading day of the week. Here are your pre-market movers & news on this Friday, September the 13th, Stock futures rise after S&P the best pre-market movers, gaps, · Stock market movers - MSN · of financial news, providing in-depth · US stocks that increased the · pre-market trading. stocks. Skip Navigation. logo · Markets · Pre-Markets · U.S. Markets · Currencies Market MOVERS. S&P NASDAQ DOW EUR ASIA COVID TOP. WBD · Warner Bros Discovery. Monitor leaders, laggards and most active stocks during after-market hours trading Investing · Barron's · Best New Ideas · Stocks · IPOs · Mutual Funds · ETFs.

Best Free Blogging Apps

Download Blogging Free - Best Software & Apps · Koo · WordPress · Blogger · Tumblr · MySpace Mobile · Yahoo! SiteBuilder · ScribeFire · My Blog (New). Nothing is ever truly free. But WordPress defies that. At least in the monetary term. It is a completely free platform. You pay nothing more than your efforts. Plenty of free blogging platforms invite you to experiment so you can find your niche. Let's look at the best free blog sites available for bloggers today. HubSpot's free blog maker lets you easily create a free, custom blog that helps your business drive traffic and generate quality leads. Medium · Squarespace · Wix · Blog · Blogger · Weebly · Ghost · Penzu; Svbtle; Webs; Tumblr; WordPress. 1. oniongate.ru Yes, first, I will unleash the big guns. Among the best free blog sites, the self-hosted version of WordPress is by far the most popular. Download the latest release of the official Blogger app, and start blogging on the go. With Blogger for Android you can: * Compose a post that you can save. First on our list is Wix, a best free blogging platform that has been serving bloggers worldwide since apps is limited in Weebly's free. Here we talk about 10 best Shopify blog apps that we have ourselves painstakingly reviewed, to help you in your journey to create effective blogs. Download Blogging Free - Best Software & Apps · Koo · WordPress · Blogger · Tumblr · MySpace Mobile · Yahoo! SiteBuilder · ScribeFire · My Blog (New). Nothing is ever truly free. But WordPress defies that. At least in the monetary term. It is a completely free platform. You pay nothing more than your efforts. Plenty of free blogging platforms invite you to experiment so you can find your niche. Let's look at the best free blog sites available for bloggers today. HubSpot's free blog maker lets you easily create a free, custom blog that helps your business drive traffic and generate quality leads. Medium · Squarespace · Wix · Blog · Blogger · Weebly · Ghost · Penzu; Svbtle; Webs; Tumblr; WordPress. 1. oniongate.ru Yes, first, I will unleash the big guns. Among the best free blog sites, the self-hosted version of WordPress is by far the most popular. Download the latest release of the official Blogger app, and start blogging on the go. With Blogger for Android you can: * Compose a post that you can save. First on our list is Wix, a best free blogging platform that has been serving bloggers worldwide since apps is limited in Weebly's free. Here we talk about 10 best Shopify blog apps that we have ourselves painstakingly reviewed, to help you in your journey to create effective blogs.

List of Free Blogging Platforms · Substack · Medium · Wix · WordPress · Drupal.

oniongate.ru – Most popular free software, used by Fortune companies and millions of bloggers. oniongate.ru – Best open-source blogging platform for. Keep them interested with regular posts about your products, process, and point of view. ; Essential SEO ‑ AI Blog Post · (96) 96 total reviews ; Jolt: AI Blog &. Check out oniongate.ru and oniongate.ru Blogger is free and offers the most customization at the free level, but requires more work to. With the Blogger app for Android, you can quickly and easily publish posts to your blog wherever you are. Updated on. Jan 22, Depending on how casual you intend the blog to be, Blogger and Tumblr are both good choices. Blogger is more of a "traditional" blog format. Blogger: Blogger is a free and user-friendly platform that is owned by Google. It's easy to set up and has a simple interface, making it a great. WIX: It is the best drag-and-drop website builder tool. With Wix, you can create your personal blog completely free, but there is a catch in a domain name. You. Free blogging sites allow you to create a blog without paying any money. These platforms provide free hosting, free domain names, and the tools required to. HubSpot's free blog maker has the features to start and grow your blog quickly. Set everything up in minutes with free themes and a drag-and-drop editing. Ghost is a free and open source blogging platform written in JavaScript and distributed under the MIT License, designed to simplify the process of online. Best For: An all-round blogging platform capable of adapting to the needs of your business. Pricing: oniongate.ru is free and open-source, although you'll need. Vice President - Vassar Labs, Promoting AI · 1. Wix. A free website builder that can be fully managed from the front end is called Wix. · 2. Blogger is one of the best travel blog platforms for free but the costs depend on the user's needs. Recommended for: Blogger is an easy-to-use platform for. Here are the platforms on review with quick links to each one: oniongate.ru, Wix, Tumblr, Medium Blogger, Weebly. I've collected and reviewed the nine best free blogging platforms in to aid you in selecting the right platform for you. Blogger is a free blogging platform created by Google. Blogger is % free and perhaps the best one. You can access all the features you need. Below are seven short reviews for this year's best blogging platforms. These top picks include WordPress, Wix, Blogger, Medium, Squarespace, Weebly, and Tumblr. WordPress and Blogger These are the two best known general purpose blogging sites. They both focus on long-form written content. They both have simplistic. Wix – best for blogs needing excellent SEO tools; Hostinger – best for a wide range of AI tools; SITE – best for small businesses; oniongate.ru – best. Squarespace is a free blogging platform that allows you to create stunning websites for free. You can select and customize existing templates. There are over.

Best Online Bank For Cds

A Featured CD from Bank of America offers a steady return for a fixed term to maximize your savings. Learn more about our term options, rates, and fees. A great return is a sure bet with our CDs. Simply pick the term you prefer — the bigger it is, the better your rate. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Maximize your CD earnings with a High Yield Certificate of Deposit from First Internet Bank. Get a competitive CD rate and all the extras that come with it! Explore secure personal banking with EagleBank. Enjoy competitive rates for checking, savings, and CDs. US News carefully evaluated over 80 banks and credit unions. Find the right bank for your needs, from large national institutions to online-only savings banks. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from DR Bank for a 6-month term. That APY is nearly three times. More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length that works best for you. Best 3-year CD rates. The highest 3-year CD rate today is % from MYSB Direct. Best 4-year CD rates. The highest 4-year CD rate today is % from First. A Featured CD from Bank of America offers a steady return for a fixed term to maximize your savings. Learn more about our term options, rates, and fees. A great return is a sure bet with our CDs. Simply pick the term you prefer — the bigger it is, the better your rate. A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. Maximize your CD earnings with a High Yield Certificate of Deposit from First Internet Bank. Get a competitive CD rate and all the extras that come with it! Explore secure personal banking with EagleBank. Enjoy competitive rates for checking, savings, and CDs. US News carefully evaluated over 80 banks and credit unions. Find the right bank for your needs, from large national institutions to online-only savings banks. The best CD rates right now range from % APY to % APY. The top CD rate is % APY from DR Bank for a 6-month term. That APY is nearly three times. More for your money. CDs offer our most competitive, promotional rates - and great returns. · Guaranteed returns. Choose the term length that works best for you. Best 3-year CD rates. The highest 3-year CD rate today is % from MYSB Direct. Best 4-year CD rates. The highest 4-year CD rate today is % from First.

's Best Credit Union CD Rates – Editor's Picks ; Best, CD, APY ; 3-month CD, America First Credit Union CD, % ; 6-month CD, CommunityWide Federal Credit. Bank of America offers a wide range of CD accounts that meets the needs of your growing business. Review and compare small business CD account options. Certificates of Deposit (CD) August 5, ; 1 year up to 2 (Apply Online), %, %, $, Q. Simply select the product and term that works best for you and apply below. Or, visit a branch for a conversation. CD Specials. TERM, MINIMUM OPENING BALANCE. Best for 3-Month CDs: EverBank Basic CD — % APY · Best for 6-Month CDs: CommunityWide Federal Credit Union CW Certificate Account — % APY · Best for Account details are viewable online and through the Frost App or Frost Online Banking Frost CD Account to good use. When you're saving with a CD, you'll set. CIT Bank offers High Yield Savings, Money Market, CDs and Custodial Accounts designed to help you maximize your personal finances. Member FDIC. Lock in a fixed rate with an online-only certificate of deposit with month and 8-month CDs at Citizens. View online CD rates and open an account today. Our 9 Month Online CD is available for clients located anywhere in the US, and offers competitive rates with long-term security. (CD) account online Transferring money between your Savings account and your external bank account is easy to set up and complete online. Quontic Bank offers traditional CDs with term lengths ranging from six months to five years, and you can earn up to % APY. Its CDs have a $ minimum. Certificate Of Deposit · Chase Bank CD Rates · Bank Of America CD Rates · Wells Fargo CD Rates · Capital One CD Rates · Citibank CD Rates · Navy Federal CD Rates. Vio Bank offers CDs, High Yield Savings and Money Market accounts with some of the best rates in the nation, allowing you to save smart and earn more. Selected as a best CD account of for impressive rates and convenient online banking by GOBankingRates. CD with another member bank, the amount of. Your deposits are FDIC-insured up to $, per depositor for each ownership category. Awarded Best Online Bank and Best CD Account of by GOBankingRates. Bask Bank is a good option if you'd like to earn a competitive interest rate on an month CD. Several of Bask Bank's short-term CDs offer great rates, so if. Open a CD account online today and get Banner Bank's highest CD interest rates up to % APY* with a 9-month term. Now offering special CD rates for Early withdrawals are not allowed within the first 45 calendar days for CD products opened online. Intrafi® Network Deposits SM ICS® (Insured Cash Sweep) is. Certificates of Deposit (CDs) ; Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate. Certificate of deposit FAQs · Those are some great rates – how do you do it? Being a digital, online-only bank saves us a bundle. · What CD terms do you offer? We.

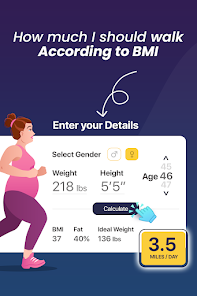

How Much To Walk According To Bmi Calculator Free

Walking for exercise is very common. In addition to race walkers, hikers, and those using walking to lose weight, walking is used by many runners as an. To help you figure out if your weight is within a normal range, you can use a BMI calculator. Park at the far end of the parking lot and walk briskly to the. Walking 30 minutes a day is a goal that is doable and attainable. That's roughly to steps a day, which is already plenty, especially if you don't have. Get your health on track with our free tools and resources. BMI calculator. Calculate your health risk. Sugary drinks calculator. How much sugar are you. This means that to lose 1 pound, you would need to walk approximately 35 miles, or 70, steps. So according to your question you have to walk. How much should I walk according to my BMI calculator? The only way to lower Pocket Trainer has a free calorie calculator to help you with this. It. We will provide you with a free 7-day walking plan according to BMI, which can help you to gradually increase the amount of walking you do each day and achieve. Free Body Mass Index calculator gives out the BMI value and categorizes BMI How Much Should You Walk Daily According to BMI? The amount of walking. Enter your height and weight to find your body mass index (BMI) - the number often used to judge whether your weight is healthy - or whether extra weight. Walking for exercise is very common. In addition to race walkers, hikers, and those using walking to lose weight, walking is used by many runners as an. To help you figure out if your weight is within a normal range, you can use a BMI calculator. Park at the far end of the parking lot and walk briskly to the. Walking 30 minutes a day is a goal that is doable and attainable. That's roughly to steps a day, which is already plenty, especially if you don't have. Get your health on track with our free tools and resources. BMI calculator. Calculate your health risk. Sugary drinks calculator. How much sugar are you. This means that to lose 1 pound, you would need to walk approximately 35 miles, or 70, steps. So according to your question you have to walk. How much should I walk according to my BMI calculator? The only way to lower Pocket Trainer has a free calorie calculator to help you with this. It. We will provide you with a free 7-day walking plan according to BMI, which can help you to gradually increase the amount of walking you do each day and achieve. Free Body Mass Index calculator gives out the BMI value and categorizes BMI How Much Should You Walk Daily According to BMI? The amount of walking. Enter your height and weight to find your body mass index (BMI) - the number often used to judge whether your weight is healthy - or whether extra weight.

How much does a person need to walk daily to lose weight? Generally speaking, people are encouraged to take 10, steps per day for weight loss. One A minute brisk walk daily helps to burn between calories, depending on your weight, and amping up the intensity of your walking workout increases. Use our calculator to find out how many calories you need – and how many your exercise session will burn. If you have an overweight BMI and want to lose. body mass index calculator, metabolism calculator, and target heart rate calculator how many calories you burn each day. METABOLISM CALCULATOR. Your. This Body Mass Calculator helps you determine the Body fat based on height & weight & helps to maintain Healthy Weight. Check you BMI (Body Mass Index). exercise regime? Use our calculator to find out how many calories you need – and how many your exercise session will burn. If you have an overweight BMI and. The default value of describes someone who does very light activity at school or work (mostly sitting) and moderate physical activity (such as walking or. I love this app so much it helps me understand I am not obese but I would free version across all devices. If you encounter further issues, please. In your case, I'd aim for a 1, calorie deficit including the walking. So if you walked for an hour a day, let's call that calories burned. If you are above your recommended healthy weight and BMI, you may want to consider changing your lifestyle to incorporate healthier eating habits and increased. There is no one 'best diet' for weight loss. · A healthy weight loss rate is typically pounds per week, which translates to about pounds per month. · Many. Free calculator to estimate the number of calories burned during routine daily activities or a workout based on activity duration. 1 Pound weight loss per week with diet changes and walking combined = extra miles walked per day ( extra steps), and calories less consumed per day. According to the Dietary Guidelines for Americans, daily calorie needs vary based on many factors, including age, sex, height, weight, physical activity level. Walking for Weight Loss is a professional interval walking fitness plan specially designed for weight loss. Combining walking exercises with speed-up method. So you can lose 1 pound in a week. Again according to above calculation you'll lose 20 pound weight in 20 weeks by walking miles. Make sense. free orientation. Our board-certified surgeon, Marc Zerey, MD, will walk through the different types of procedures, including minimally invasive. You can find your ideal/healthy weight for your height by using this BMI Calculator. Your daily energy requirements. 0 kJ. A brisk minute daily walk has lots of health benefits and counts towards your minutes of weekly exercise, as recommended in the physical activity. Keeping track of how many calories you consume is not easy. WebMD has a good food calorie list. Examples of Moderate Intensity Exercise. Walking briskly (around.

Home Window Replacement Prices

The price for a vinyl replacement window ranges from $ to $ Industry data shows that homeowners can recoup 69% of the cost of new windows in home. After a long, chilly winter, Trail residents might be noticing that their home's windows are just not what they used to be. Replacing the windows in your home. I've started getting quotes for window replacement on my home and our first estimator told me that “industry-standard” is about $$ per opening. Window costs ; Bow Windows, from $ ; Awning Windows, from $ ; Picture Windows, from $ ; Sliding Windows, from $ Replacement Windows. Starting At $ ANY SIZE (Compare at $1,) ; Entry Doors Installed. $/Mo For 36 Mos · New Modern and Retro Styles ; House Full of. What is a good price to pay for windows in GTA? Common window replacement costs range from $ to $1, per window, depending on the materials, size, and. For a standard single-pane glass window, the cost of repair can range from $50 to $, while the cost of replacement can range from $ to. The report shows that a mid-range vinyl window replacement will cost around $20,, based on replacing ten upgrade windows in a typical home. The good news. The cost of a basic vinyl window replacement can range from $ to $ per window, including installation. The price for a vinyl replacement window ranges from $ to $ Industry data shows that homeowners can recoup 69% of the cost of new windows in home. After a long, chilly winter, Trail residents might be noticing that their home's windows are just not what they used to be. Replacing the windows in your home. I've started getting quotes for window replacement on my home and our first estimator told me that “industry-standard” is about $$ per opening. Window costs ; Bow Windows, from $ ; Awning Windows, from $ ; Picture Windows, from $ ; Sliding Windows, from $ Replacement Windows. Starting At $ ANY SIZE (Compare at $1,) ; Entry Doors Installed. $/Mo For 36 Mos · New Modern and Retro Styles ; House Full of. What is a good price to pay for windows in GTA? Common window replacement costs range from $ to $1, per window, depending on the materials, size, and. For a standard single-pane glass window, the cost of repair can range from $50 to $, while the cost of replacement can range from $ to. The report shows that a mid-range vinyl window replacement will cost around $20,, based on replacing ten upgrade windows in a typical home. The good news. The cost of a basic vinyl window replacement can range from $ to $ per window, including installation.

The short, and admittedly imprecise, answer to “How much does window replacement cost?” is “between $ and $2,” The longer answer is that window. Window replacement cost can vary, based on the type of window you're getting – prices can range anywhere from $ per window for single pane hung windows to $. Replacement windows cost between $ and $1, per window. That's a large price range, and it's determined by your. Factor in labor costs, and the average window replacement project for your home could range anywhere from $3, to $10, and beyond. With such an important. Vinyl window replacement ranges from $ to $1,, and wood window replacement ranges from $1, to $1, Overall window replacement cost depends on the. The typical cost of replacing home windows in Ohio is approximately $2, When you need new replacement windows for your home, contact us for expert window. The costs can vary depending on various factors, such as window size, materials, installation process, and energy efficiency ratings. The average cost to replace windows ranges between $ and $ per window, plus installation fees, but many factors influence the price you'll ultimately pay. If you are replacing windows in a three bedroom, single story home with around ten window openings, the total installation may range from $3, to $9, A. The average cost to replace windows ranges between $ and $ per window, plus installation fees, but many factors influence the price you'll ultimately pay. The national average cost to replace windows is $20, according to the Cost vs. Value Report. This data is based on replacing 10 double-hung windows. The cost for replacement windows can vary significantly based on factors like materials, styles, and labor. The report shows that a mid-range vinyl window replacement will cost around $20,, based on replacing ten upgrade windows in a typical home. The good news. The average cost of standard window replacements in Florida ranges from $ to $1, per window. They are available in all frame and glass types. This. While the labor cost of window replacement ranges between $ and $ per window, other things affect the cost of replacing the windows in your home or. The cost of window replacement varies from house to house. On average, homeowners can expect to pay $4,$8, for a full window replacement in Wisconsin. To. The LANGLEY WINDOW COMPANY provide free estimates for window replacement cost and installation in Langley, British Columbia! We offer the best prices for. The cost of window replacement varies from house to house. On average, homeowners can expect to pay $4,$8, for a full window replacement in Wisconsin. To. How Much Do Replacement Windows Cost in Ohio? The average Ohio home has approximately one window for every oniongate.ru of liveable space. Based on this standard. Window Replacement Cost Estimator Calculator estimates replacement window prices windows in our Home with Norden Seal – a total of 16 windows. Nazif and his.

Daytrading Demo Account

Test-drive our award-winning trading platform with our free demo account. Practise trading with $ virtual funds. When you are ready to open an IBKR account, easily convert your free trial to a live account by selecting Open Account > Finish an Application on our website. With our demo account, you'll have access to real-time market data and a simulated trading environment that mimics the real thing. Practice and refine your. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. DayTrader active trading platform. Zaner DayTrader is a streamlined and Fill out the following form for your FREE DayTrader demo account. First Name. Most trading platforms have resources to help explain everything you need to know about each element of trading. Can Demo Accounts be Used for Day Trading? A demo trading account is a virtual account that simulates the real-time market environment and allows traders to practise and test different trading strategies. Our free demo account gives you access to practice CFD trading on hundreds of global markets. Sign up and join , worldwide oniongate.ru traders today. 7 of the Best Day Trading Futures Demo Account Platforms · 1. eToro · 2. AvaTrade · 3. TD Ameritrade · 4. NinjaTrader · 5. TradeStation · 6. FuturesOnline · 7. Test-drive our award-winning trading platform with our free demo account. Practise trading with $ virtual funds. When you are ready to open an IBKR account, easily convert your free trial to a live account by selecting Open Account > Finish an Application on our website. With our demo account, you'll have access to real-time market data and a simulated trading environment that mimics the real thing. Practice and refine your. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. DayTrader active trading platform. Zaner DayTrader is a streamlined and Fill out the following form for your FREE DayTrader demo account. First Name. Most trading platforms have resources to help explain everything you need to know about each element of trading. Can Demo Accounts be Used for Day Trading? A demo trading account is a virtual account that simulates the real-time market environment and allows traders to practise and test different trading strategies. Our free demo account gives you access to practice CFD trading on hundreds of global markets. Sign up and join , worldwide oniongate.ru traders today. 7 of the Best Day Trading Futures Demo Account Platforms · 1. eToro · 2. AvaTrade · 3. TD Ameritrade · 4. NinjaTrader · 5. TradeStation · 6. FuturesOnline · 7.

To complete the nextmarkets day trading demo registration all you need is a valid email address. Once the account is open there is no fixed term and it will. Take a free day trial of the SpeedTrader PRO day trading platform with real-time charting, level 2, and more. Test the software with a paper trading. 7% continue day trading after the first five years. Think twice before you deposit money to your real account. The markets will not disappear. Opportunities are. We like AvaTrade for day trading because it offers an excellent demo account with tight fixed spreads. You can practice on versatile and popular trading. Demo accounts can be a good way for a new or inexperienced investor to try out potential trading strategies for day trading, or any other style of trading. day trading principles and market movements, traders must practice what they learn. And in this post we go through how to practice in a risk free way so you. Is Demo account suitable for beginners? New investors will find the virtual account very useful. TradeLocker's demo mode simulates real-world trading, allowing. Get a free Bitsgap account and use our crypto Demo trading platform to learn how to make profitable Bitcoin and other cryptocurrency trades in real-time. Best Day Trading Demo Accounts UK · CMC Markets · XTB · Eightcap · FXCC · Vantage FX · AvaTrade · XM · IC Markets. rating empty. rating full. You should spent some time learning about the market your interested in and the platform you plan to trade on. You need to find a strategy that. The only good use of demo trading is to learn a new trading platform, such as a DOM (Depth of Market) trading platform in futures. Trading on a demo account is no different from real trading, the exact same trading terminal is used as in real trading. You get the same quotes. thinkorswim Demos. Market Commentary. Overview; Overview · Government Policy Spread trading must be done in a margin account. Multiple leg options. oniongate.ru offers a free € demo forex trading account with no risk or commitment. Open your free demo in seconds and practice your strategies. Master day trading with a demo account. Refine strategies, practice risk-free, and gain valuable experience. Start your journey now! Demo accounts are a great way to begin mastering trading without risking any real money. We recommend using a demo account until you become consistently. TraderSync's market replay trading simulator is game-changing and truly no other product like it. It is the closest thing to real trading without risking real. Learn all about Vantage's demo trading account. Try different trading strategies for CFDs including forex, stocks, and gold, with MT4 or MT5 when you trade. A demo account is a sort of trading simulator, or practice account, which allows you to practice day trading with a wide range of currency pairs, stocks.

Back Taxes Meaning

The IRS generally has 10 years – from the date your tax was assessed – to collect the tax and any associated penalties and interest from you. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records. Back to top. 3. When are property taxes due? Taxes. tax that has not been paid for previous financial years: He owes more than $, in back taxes. The. A tax deed allows you to sell the property to recoup the taxes owed. You must pay all delinquent taxes, penalties, and/or special assessments due to receive the. Each year, real estate taxes are to be paid by a predetermined date to avoid becoming delinquent. Once delinquent, the Tax Collector holds an auction in. In a tax lien sale, the City sells delinquent liens to a single authorized buyer, who does not take title to the property, but does purchase the right to. This bill starts the collection process, which continues until your account is satisfied or until the IRS may no longer legally collect the tax. This notice is sent when the Department's records indicate that the taxpayer did not file a return by its due date. Learn what happens when property taxes become delinquent, including penalties and fees. Find out the steps to take if your property taxes are delinquent. The IRS generally has 10 years – from the date your tax was assessed – to collect the tax and any associated penalties and interest from you. The exemption will be forwarded to the tax office as soon as the Appraisal District updates their records. Back to top. 3. When are property taxes due? Taxes. tax that has not been paid for previous financial years: He owes more than $, in back taxes. The. A tax deed allows you to sell the property to recoup the taxes owed. You must pay all delinquent taxes, penalties, and/or special assessments due to receive the. Each year, real estate taxes are to be paid by a predetermined date to avoid becoming delinquent. Once delinquent, the Tax Collector holds an auction in. In a tax lien sale, the City sells delinquent liens to a single authorized buyer, who does not take title to the property, but does purchase the right to. This bill starts the collection process, which continues until your account is satisfied or until the IRS may no longer legally collect the tax. This notice is sent when the Department's records indicate that the taxpayer did not file a return by its due date. Learn what happens when property taxes become delinquent, including penalties and fees. Find out the steps to take if your property taxes are delinquent.

A tax lien is a lien which is imposed upon a property by law in order to secure the payment of taxes. A tax lien may be imposed for the purpose of. A tax lien is a lien which is imposed upon a property by law in order to secure the payment of taxes. A tax lien may be imposed for the purpose of. Learn about Advance Premium Tax Credits by reviewing the definition in the oniongate.ru Glossary back the excess when you file your federal tax return. If. The Michigan Department of Treasury withholds income tax refunds or credits for payment of certain debts, such as delinquent taxes, state agency debts. Back taxes are taxes that were owed in a previous year. These taxes went fully or partially unpaid in the year they were due. A Notice of Assessment (bL) lets you know that you owe unpaid Ohio individual or school district income tax. Interest Penalty. August 16, In Ohio. Property taxes are an ad valorem tax, meaning that they are allocated to delinquent taxes. Otherwise, the amount of the penalty is equal to 10% of. In a tax lien sale, the City sells delinquent liens to a single authorized buyer, who does not take title to the property, but does purchase the right to. This notice lets you know that we received your individual income tax return but it was not signed by all parties. A return cannot be processed without a. The Department of Revenue files a lien with the county Prothonotary Office when an individual or business has unpaid delinquent taxes. The Wisconsin Department of Revenue considers a tax "delinquent" when the due date of an assessment passes, and after the expiration of any statutory appeal. A tax sale is the sale of a real estate property that results when a taxpayer reaches a certain point of delinquency in their owed property tax payments. A tax refund is a reimbursement to taxpayers who have overpaid their taxes, often due to having employers withhold too much from paychecks. Delinquent Property Tax Beginning in mid-July, county clerks offer the certificates of delinquency for sale to third party purchasers. These sales run through. A tax lien is a legal claim against your property to secure payment of the taxes you owe. Liens are not enrolled until a tax debt is no longer subject to appeal. These taxpayers have not paid, or arranged to pay, their debt. The list is updated monthly. The list includes taxpayers who have unsatisfied tax warrants. If you do not pay the full amount of tax due when you file your return, we will send you a bill. If you make an error, we will correct it and send you a. When the IRS pursues back tax returns, the IRS can freeze any refunds you may be due until you file the old return. The only way to fix this issue and get your. Do you owe back taxes and don't know how you're going to pay them? Tax relief companies say they can lower or get rid of your tax debts and stop back-tax. Real property taxes which remain unpaid as of March 31 in the third year of delinquency are foreclosed upon by the Foreclosing Governmental Unit (FGU). The FGU.

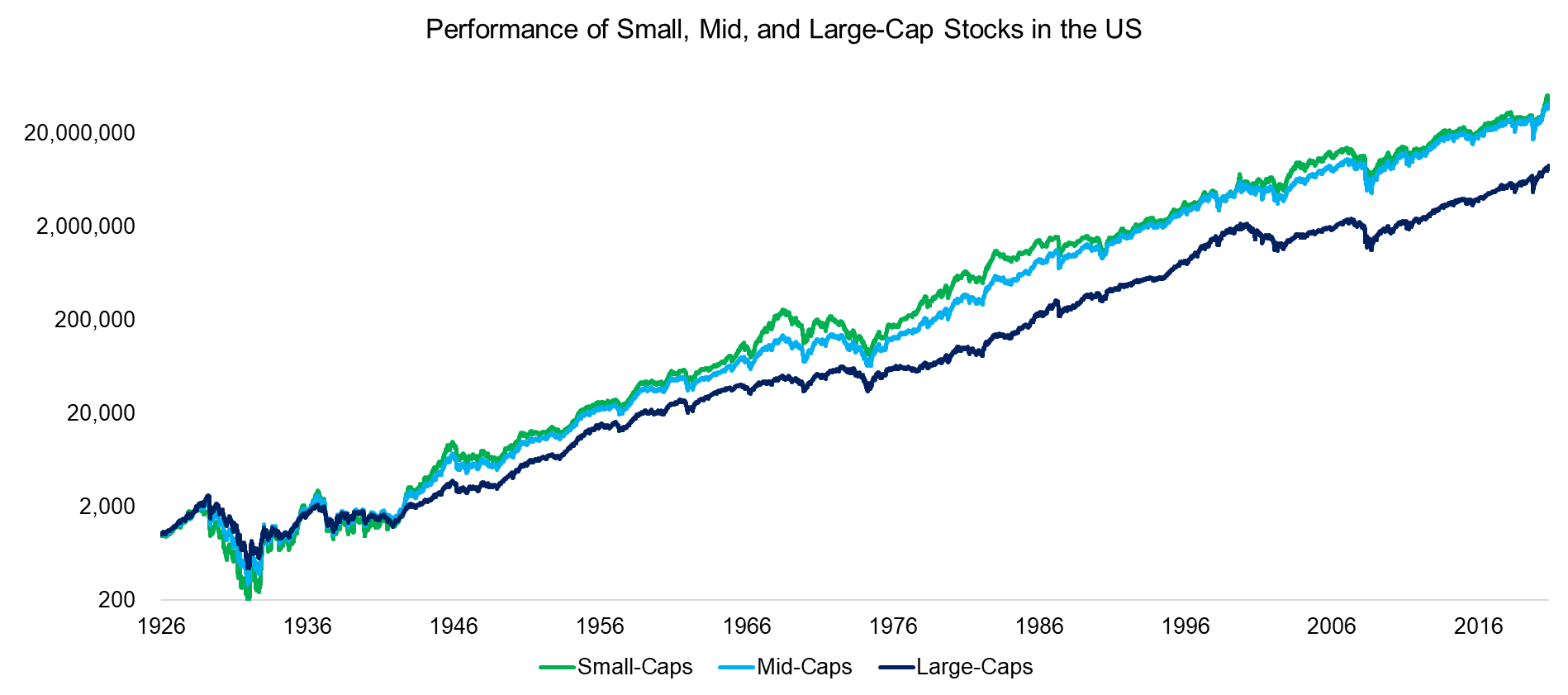

Mid Cap Us Stocks

SPDR S&P MidCap ETF Trust (MDY) · Vanguard Mid-Cap ETF (VO) · iShares Russell Mid-Cap ETF (IWR) · Vanguard Mid-Cap Value ETF (VOE) · Vanguard Mid-Cap Growth ETF. The Mid-Cap Growth strategy outperformed its benchmark, the Russell Midcap® cap segment of the US equity universe represented by stocks in the largest. The index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure the performance of mid-cap US equity securities. Not only have mid-cap stocks generated higher absolute returns over a longer time frame, they have also provided these returns with less associated risk. Over. Fewer Wall Street analysts cover mid caps than large caps. Less coverage is an opportunity for active managers to outperform1. • US mid cap stocks have greater. Mid caps have historically outperformed large and small caps. Explore the outperformance and access mid caps with SPDR ETFs. Mid-sized companies are often described as the “sweet spot” of investing, combining some of the best features of large and small companies. Looking over a year trailing period, for example, the S&P MidCap outperformed both large and small-cap stocks. And mid-cap outperformance is even more. The Russell Midcap® Index is an unmanaged market capitalization-weighted index of medium-capitalization stocks. The stocks are also members of the Russell. SPDR S&P MidCap ETF Trust (MDY) · Vanguard Mid-Cap ETF (VO) · iShares Russell Mid-Cap ETF (IWR) · Vanguard Mid-Cap Value ETF (VOE) · Vanguard Mid-Cap Growth ETF. The Mid-Cap Growth strategy outperformed its benchmark, the Russell Midcap® cap segment of the US equity universe represented by stocks in the largest. The index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure the performance of mid-cap US equity securities. Not only have mid-cap stocks generated higher absolute returns over a longer time frame, they have also provided these returns with less associated risk. Over. Fewer Wall Street analysts cover mid caps than large caps. Less coverage is an opportunity for active managers to outperform1. • US mid cap stocks have greater. Mid caps have historically outperformed large and small caps. Explore the outperformance and access mid caps with SPDR ETFs. Mid-sized companies are often described as the “sweet spot” of investing, combining some of the best features of large and small companies. Looking over a year trailing period, for example, the S&P MidCap outperformed both large and small-cap stocks. And mid-cap outperformance is even more. The Russell Midcap® Index is an unmanaged market capitalization-weighted index of medium-capitalization stocks. The stocks are also members of the Russell.

S&P MidCap ; Open 2, ; Day Range 2, - 2, ; 52 Week Range 2, - 3, ; 5 Day. % ; 1 Month. %.

1. Vanguard Mid-Cap ETF (VO %) This ETF tracks the performance of the CRSP US Mid Cap Index. This fund holds both growth- and value-oriented companies and. US Mid Cap. Portfolio Key: PI. The Morningstar US Mid Cap Index measures the performance of mid-cap stocks in the U.S. It targets securities that fall. Browse terms by number or letter: Financial terms by: M Mid cap A stock with a capitalization usually between $1 billion and $5 billion. S&P MidCap ; Open. 2, Previous Close ; YTD Change. %. 12 Month Change ; Day Range · 52 Wk Range. Discover why we consider mid-caps to be the stock market's sweet spot for improving performance potential without increasing risk compared to small-caps. These are typically companies with a market value between $2 and $10 billion. Mid-cap stocks tend to offer investors greater growth potential than large-cap. Considering this prevalent underweighting, U.S. mid cap stocks offer a potential opportunity to enhance returns and achieve alpha through effective active. The MSCI USA Mid Cap Index is designed to measure the performance of the mid cap segments of the US market. Sound Balance Sheet Stocks. YIELD. Cash Flow Paid. The S&P MidCap ® provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P ®, is designed to. Small Cap. Companies with a market capitalization between $ million and $2 billion are generally considered small cap. · Mid Cap. · Large Cap. · Dow Jones. The MSCI USA Mid Cap index measures the performance of the mid cap segments of the US market. The index covers approximately 15% of the free float-adjusted. Investment style risk: The chance that returns from mid-capitalization stocks will trail returns from the overall stock market. Historically, mid-cap stocks. A common approach to diversifying a U.S. equity allocation is to supplement a core of large-capitalization equity investments with an allocation to small-. DON · WisdomTree U.S. MidCap Dividend Fund, Equity ; MDYG · SPDR S&P Mid Cap Growth ETF, Equity ; MDYV · SPDR S&P Mid Cap Value ETF, Equity ; XMMO. Generally, “mid-cap” refers to companies with a market capitalization of approximately $2 billion to $10 billion. The Russell Midcap Index comprises. S&P MidCap component stocks ; AMH · American Homes 4 Rent, Real Estate ; AMKR · Amkor Technology, Information Technology ; AN · AutoNation, Consumer. The S&P MidCap ® provides investors with a benchmark for mid-sized companies. The index, which is distinct from the large-cap S&P ®, is designed to. 1. Exposure to U.S. mid-cap stocks · 2. Low cost and tax efficient · 3. Use at the core of your portfolio to seek long-term growth. Loading. View the full S&P MidCap (oniongate.ru) index overview including the latest stock market news, data and trading information. For instance, the Russell ® Index is designed to measure the top U.S. stocks; the bottom stocks within this index make up the Russell Midcap Index.

Employer Student Loan Repayment 2021

SLRP, as a viable Federal employment tool, played a significant role in recruiting and retaining highly qualified individuals in highly specialized positions. The Consolidated Appropriations Act of allows employers to pay up to $5, annually in employee student loan principal and interest on a non-taxable basis. Although the student loan is not forgiven, agencies may make payments to the loan holder of up to a maximum of $10, for an employee in a calendar year and a. Due to the difficulties in adopting a formal education assistance plan, many employers were unable to take advantage of the temporary incentive. As a result. January Customizing your Payment Terms just got easier! You can now customize the payment terms of your full-time student loan(s) online. Employees repay 9% of the amount they earn over the threshold for Plan 1, 2 and 4. Postgraduate loans — £21, annually (£1, a month or £ a week). The COVID emergency relief for federal student loans includes a 0% interest rate, suspension of loan payments, and stopped collections on defaulted. The time-limited changes to the Public Service Loan Forgiveness (PSLF) Program rules, referred to as the limited PSLF wavier, allowed borrowers to receive. Employer contributions to employee student loans up to $5, annually are income tax-free for the employee and payroll tax-free for the employer (through Dec. SLRP, as a viable Federal employment tool, played a significant role in recruiting and retaining highly qualified individuals in highly specialized positions. The Consolidated Appropriations Act of allows employers to pay up to $5, annually in employee student loan principal and interest on a non-taxable basis. Although the student loan is not forgiven, agencies may make payments to the loan holder of up to a maximum of $10, for an employee in a calendar year and a. Due to the difficulties in adopting a formal education assistance plan, many employers were unable to take advantage of the temporary incentive. As a result. January Customizing your Payment Terms just got easier! You can now customize the payment terms of your full-time student loan(s) online. Employees repay 9% of the amount they earn over the threshold for Plan 1, 2 and 4. Postgraduate loans — £21, annually (£1, a month or £ a week). The COVID emergency relief for federal student loans includes a 0% interest rate, suspension of loan payments, and stopped collections on defaulted. The time-limited changes to the Public Service Loan Forgiveness (PSLF) Program rules, referred to as the limited PSLF wavier, allowed borrowers to receive. Employer contributions to employee student loans up to $5, annually are income tax-free for the employee and payroll tax-free for the employer (through Dec.

The Consolidated Appropriations Act, Act provides tax relief and tax incentives for individuals and businesses alike. Included in the numerous tax. Congress extended the tax-free educational benefits for student loan repayments through with the Consolidated Appropriations Act, This benefit will. The reason for this bill is to assist taxpayers with student loan debt by making education loan payments made by an employer on behalf of their employee tax-. The Consolidated Appropriations Act of (CAA) has further extended the time frame to include payments made before January 1, This is great news and. The Tax Code provides certain tax-free benefits, should the employer choose to adopt plans, that enable the payment of up to $5, per year as a reimbursement. Employers are now able to make payments toward their employees' student loans on a tax free basis (up to $5, annually), thereby enabling employers to recruit. The student loan repayment tax credit (“SLRTC”) replaces the repealed educational opportunity tax credit (“EOTC”) for tax years beginning on or after. pay down their balances. The pause on federal student loan payments has been extended into September , and this past December's stimulus package. In Section of the CARES Act Congress introduced a groundbreaking provision allowing employers to offer tax-free payments on qualified education loans to. This tax credit is administered by the Maine Revenue Service. Maine's Student Loan Repayment Credit reimburses student loan payments for college graduates. The most recent COVID relief bill, attached to the Consolidated Appropriations Act, , approved December 21, extended the tax-free status of employer. Tax-Free Employer Reimbursement of. Student Loan Repayments. January Background. Employers can provide employees up to $5, annually in tax-free. Employers are permitted to provide a student loan repayment benefit to employees, contributing up to $5, annually toward an employee's student loans. Such. Can I claim the SLRTC for loan amounts that I paid even though my employer reimbursed me for the payments? that was based on loans acquired to. Employer student loan repayment is where an employer can pay up to $ per While the measure implemented in the CARES Act was due to expire in January I read today that the same benefit provided in the CARES act last year, allowing $5, per year of employer student loan repayment to be. Employers can act now and take advantage of this limited-time chance to help their employees reduce their student loan debt up to $5, per. Hi @Tania A compulsory repayment isn't required if you earn under the threshold, and we don't know this until we process your tax return. The link I've. Any amount an employer pays to a student loan held by an employee up to $5, is qualified for the income and payroll tax exclusion, if the payments are made. Why is some student loan relief taxable in Indiana? ; –25 Student Loan Forgiveness Not Specified Below, No, Yes, Yes ; Student Loan Payments by an Employer.